Google Stock Split Is Approved: What’s The Stock Outlook? (NASDAQ:GOOG)

Justin Sullivan/Getty Photos Information

Alphabet (NASDAQ:GOOGL) has authorised a 20-for-1 stock split, its initially due to the fact 2014. This inventory split has the likely to improve liquidity and pave the way for many enlargement, a little something that has eluded the stock. The company is arguably getting the correct techniques to generate a premium numerous which includes its intense share repurchase system. GOOGL signifies a person of the most powerful hazard-reward options nevertheless accessible in the sector today.

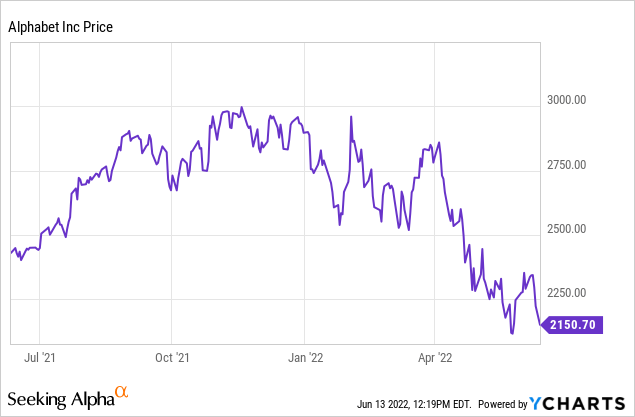

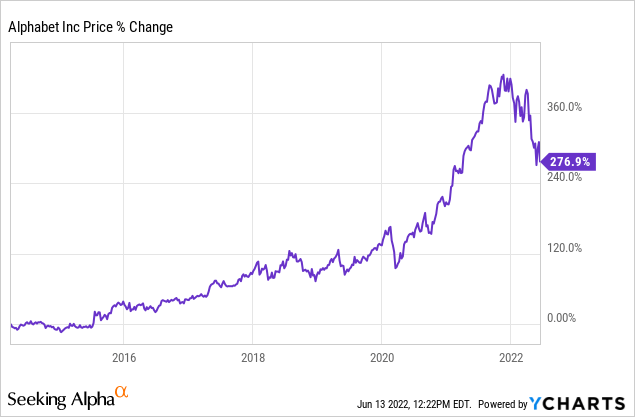

Google Inventory Selling price

GOOGL peaked all-around $3030 per share and has considering the fact that dropped 30%.

I final protected the identify in Oct of final calendar year, when I referred to as it a powerful purchase based mostly on the company design, stability sheet power, and share repurchases. The business carries on to produce stellar results all whilst utilizing a share repurchase software that will only be extra successful with these reduced charges. This is a stock which has tested time and time all over again why it deserves to be a person of the most significant holdings in the Ideal of Breed portfolio.

Google Stock Critical Metrics

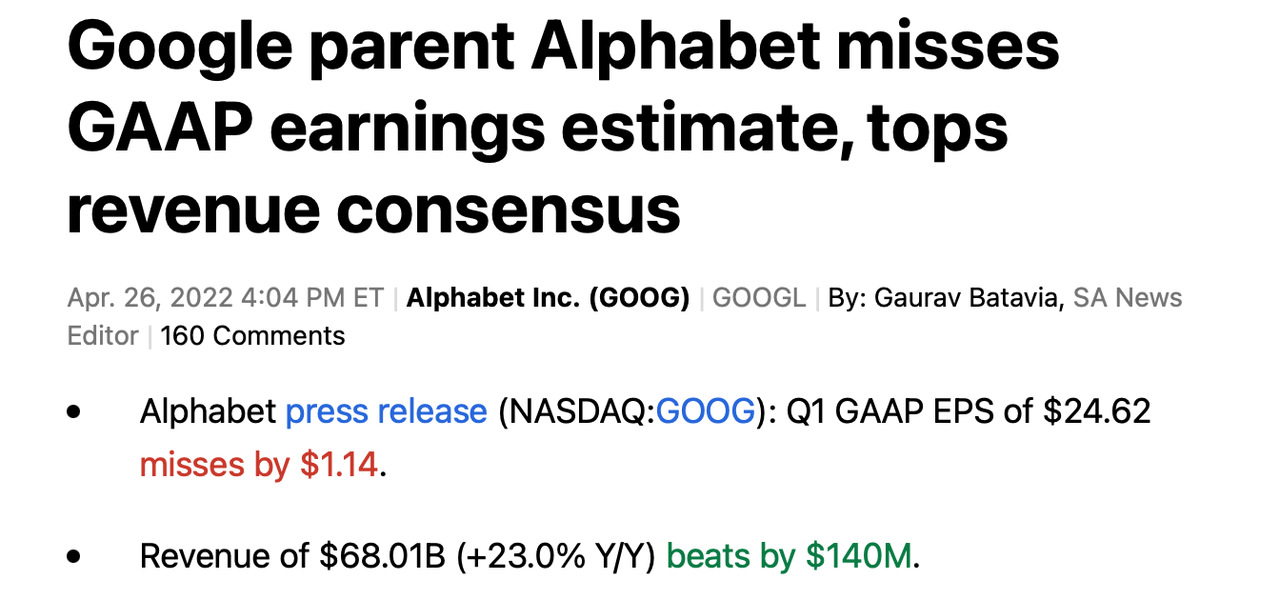

Let us examine the new earnings report. The headlines confirmed an earnings pass up.

Seeking Alpha

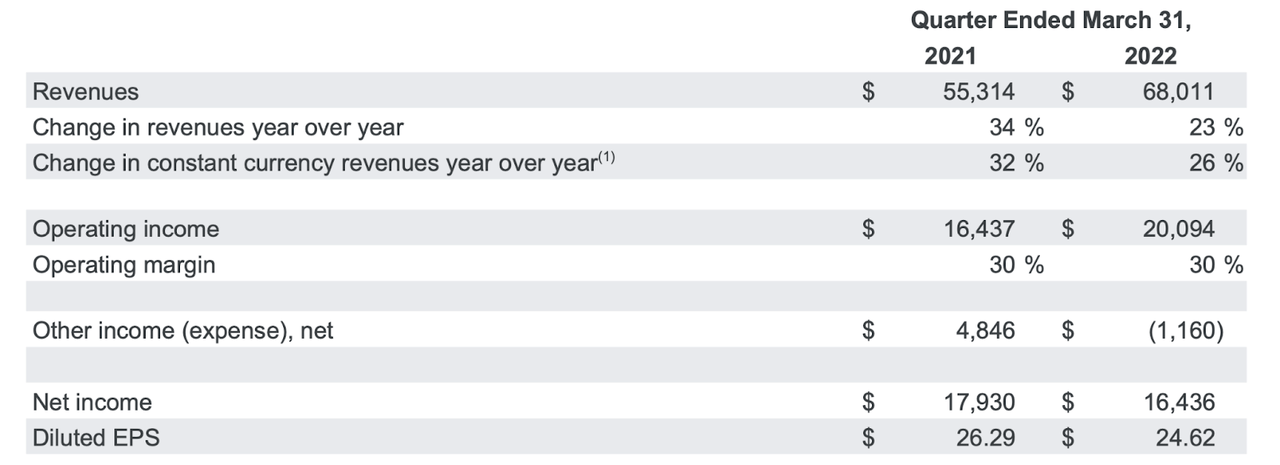

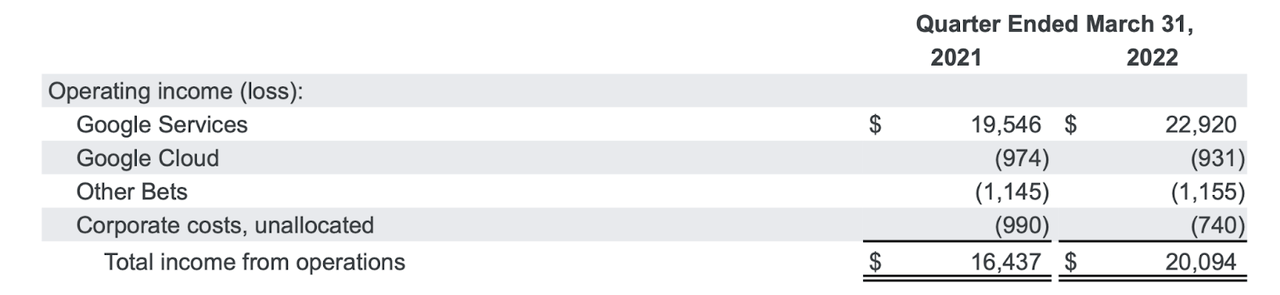

Earnings are often misunderstood at GOOGL due to their large investment portfolio. Unrealized gains are required to be demonstrated on the income statement ever due to the fact 2019, even though those gains (or losses) do not mirror operational earnings. We can see beneath that operating revenue grew 23% more than the prior yr, even as internet earnings went down.

2022 Q1 Press Launch

On an altered basis (my adjustment for unrealized gains), GOOGL attained $26.77 in EPS compared to $19.24 in the prior quarter. That displays growth of 39%.

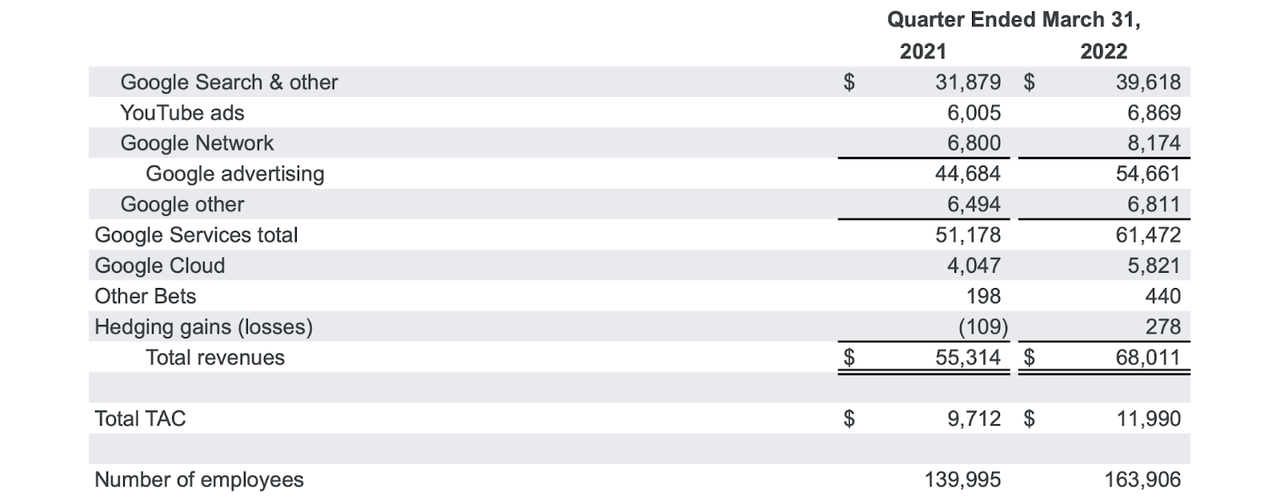

GOOGL posted good development in all segments, although YouTube progress was amazingly weak.

2022 Q1 Press Launch

Aspect of that was owing to the Ukraine war, but mostly it was thanks to an growing amount of “Shorts,” which is YouTube’s answer to TikTok. This is absolutely nothing new: each time these organizations unveil new video formats, the monetization is constantly reduced at 1st. Analysts are looking for any motive to offer tech stocks nowadays, especially names like GOOGL which has not fallen as a lot as peers. In the prolonged time period, quarter to quarter volatility is meaningless: on the net advertising continues to be 1 of the strongest secular development tales in the sector right now – specially for the firm that owns look for.

GOOGL ongoing to print dollars, but working earnings did not expand speedier than revenues.

2022 Q1 Press Launch

I have reviewed for subscribers how earnings at tech providers, in particular the likes of Meta (META) and GOOGL, are deeply understated thanks to the intense financial investment in advancement. I see analyst following analyst criticizing GOOGL for the lack of operating leverage, which include the working losses at Google Cloud. Some have even mentioned items like if Google Cloud isn’t really producing income, then does it matter?

My view is that Google Cloud could be lucrative if it desired to, but the firm is selecting new headcount so rapidly that any top-line gains are much more than offset by increased bills. You can count on this to be accurate in all departments at the organization. Here is the irony: even though many buyers are upset with the understated earnings, buyers ought to really want GOOGL to report as little earnings as feasible. Considerably less earnings implies additional investments in expansion, and GOOGL has historically been a phenomenal allocator of R&D dollars.

On the other hand, GOOGL has historically been a very poor allocator of shareholder earnings, as evidenced by the traditionally increasing money

hoard. This is in my viewpoint the only critical metric worth focusing on proper now (GOOGL is such a very clear-slice tale that concentrating on quarter to quarter numbers is missing the even larger photograph). Matters are looking up, however.

In the very last quarter, GOOGL generated $15.3 billion of absolutely free hard cash flow and used $13.3 billion on share repurchases as nicely as $2.9 billion on payments similar to inventory-dependent award actions. In other text, GOOGL has eventually taken on a cash allocation plan that I have been vouching for pretty a whilst. The corporation is directing all of its absolutely free income stream in the direction of share repurchases. With the net income position now at in excess of $100 billion, there is no have to have to continue on hoarding hard cash – and management at last would seem to understand this. On April 20th, GOOGL authorized a $70 billion share repurchase method. It seems to be like this business has lastly matured from a cash-hoarding arrogant tech organization to a shareholder-targeted mature company.

When Was Google’s Inventory Split Accepted?

At the 2022 Once-a-year Shareholder’s Conference on June 1st, GOOGL shareholders approved a 20-for-1 stock split. This implies that for every single share, shareholders will get 20 shares at the close of the organization working day on July 15th.

How Quite a few Times Has Google Stock Split?

This is the initial time GOOGL has break up considering the fact that its initial break up on April 3, 2014, when the organization executed a 1998-for-1000 stock split. The position of that inventory split was to make the new Course C shares, an celebration which aided the firm’s founder retain voting handle of the company.

How Did Google Stock Do Right after Its Past Stock Split?

Given that that 2014 stock break up, GOOGL has returned approximately 300%.

I’d make the argument that the strong inventory price tag efficiency was not owing to the inventory split but as an alternative owing to the robust underlying essential overall performance – the corporation enhanced earnings from $21.02 for every share in 2014 to $94.06 for each share in 2021. Concerning this most current inventory break up, nevertheless, a person could issue out that it may possibly be far more significant because of to the larger selection of shares being created in the transaction. Inventory splits do not change the elementary benefit of the inventory, but the lower stock price tag may perhaps assist to improve liquidity, as some retail traders may possibly favor decrease stock selling prices and may possibly come across it easier to trade possibilities on the inventory.

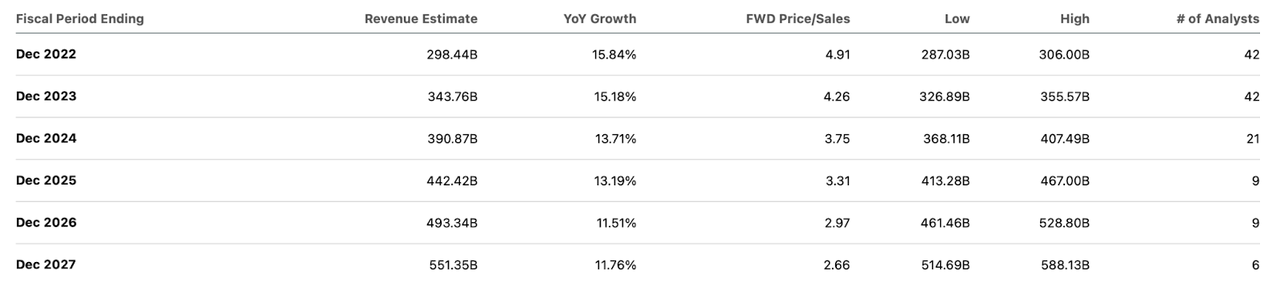

Is Google A Excellent Long-Term Financial investment?

With a commanding situation in on the web advertising and marketing, GOOGL stays a persuasive very long-term investment decision. We can see down below that consensus estimates simply call for double-digit topline development for a lot of many years to occur.

Seeking Alpha

Assuming operating leverage, that major-line development could lead to even higher earnings per share expansion.

In contrast to peers like Meta, GOOGL retains comprehensive command above a lot of its platforms, like look for and YouTube. That helps make it much more equivalent to Apple (AAPL). However AAPL is investing at the exact same 22x earnings various as GOOGL. That valuation comparison is curious taking into consideration that AAPL is projected to improve at half the fee of GOOGL. GOOGL also has an 8.4% net income position (vs . 3.3% at AAPL). On a development-modified foundation, GOOGL is buying and selling with terrific undervaluation relative to AAPL.

Is Google Inventory A Acquire, Promote, Or Keep?

That undervaluation could not past eternally. I have the check out that AAPL attained its quality numerous generally thanks to its intense share repurchase application. GOOGL has started a comparable endeavor and nevertheless has plenty of web hard cash on its stability sheet to fund aggression in the potential. AAPL is trading at all around a 2x price to earnings advancement ratio (‘PEG ratio’). GOOGL, on the other hand, trades at a lot less than a 1x PEG ratio. On a like-for-like foundation, GOOGL could trade up 100% to basically match AAPL on a PEG ratio basis. That would place the inventory at close to 44x earnings, an arguably acceptable various looking at the sustainable double-digit growth and ongoing share repurchases. Over the extensive expression, I could see GOOGL settling for a 25x to 30x earnings a number of. That suggests that shareholders could benefit from equally the gains of compounded yearly expansion as properly as extended-term many enlargement. GOOGL isn’t really investing as cheaply as quite a few tech peers, but its powerful margins and apparent outlook make it a persuasive expense opportunity, nevertheless. What are the key threats below? In excess of the close to term, promoting devote could working experience volatility, which would negatively effect GOOGL’s growth charge and margins. There may well also be regulatory hazard as mega-cap tech giants are effortless targets for fines, and in all honesty, GOOGL’s enterprise feels quite a great deal like a monopoly (after all, that is what would make this inventory so powerful). It is arguably unclear if breaking up the business enterprise would seriously be poor for shareholders, but these kinds of a likelihood may perhaps keep on being as an overhang on multiples until eventually settled. I check out the point that management has embraced share repurchases as helping to offset the chance of compressed multiples, as the business will be able to get advantage of low inventory charges. I charge GOOGL a solid buy dependent on each the potent expansion outlook and multiple expansion possible. GOOGL continues to be a main anchor of the Finest of Breed portfolio.