Google: The Best FAANG Stock By Far (NASDAQ:GOOGL)

Justin Sullivan

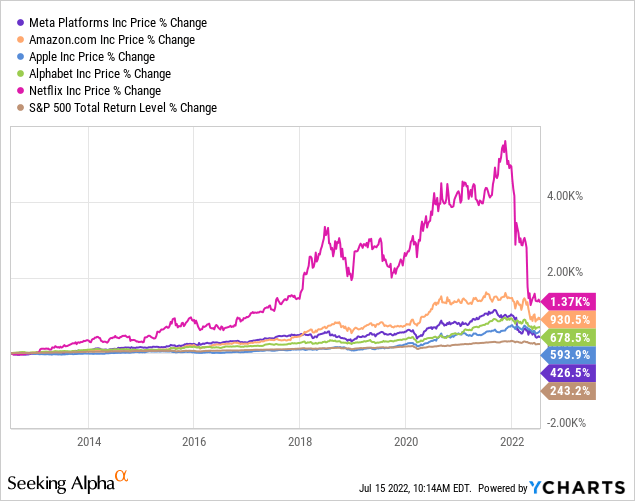

I feel every person here has heard about the FAANG shares, as these major tech names have delivered outstanding returns about the past ten years. While some of the companies have adjusted their title around that time, the letters depict Fb/Meta Platforms (META), Apple (AAPL), Amazon (AMZN), Netflix (NFLX), and Google – or as it truly is now regarded, Alphabet (GOOG, NASDAQ:GOOGL).

Any buyers in these firms considering the fact that 2012 have been really effectively rewarded, with each and every enterprise comfortably outperforming the benchmark S&P 500.

But investing is a ahead-hunting sport, so which of these companies should really see the best amount of achievement in the decade to occur? Although you could make a powerful circumstance for any, my select is Alphabet, and I’ll tell you why.

Company Overview

Alphabet divides alone up into two core Google-relevant segments: Google Solutions and Google Cloud, with a additional phase for Other Bets.

The products and solutions and platforms at the coronary heart of Google Services contain adverts, Android, Chrome, components, Gmail, Google Generate, Google Maps, Google Shots, Google Engage in, Research, and YouTube. These are all providers that we arrive into speak to with every day I’m now working with Google Chrome and Google Research to do a lot of the exploration for this posting. The hardware items also made available by Google contain the Pixel smartphones, Fitbit, Chromecast, and the Google Nest Cams and Doorbell.

Google Cloud is the company’s cloud system & a challenger to the likes of Amazon’s AWS and Microsoft’s Azure. It also gives Google Workspace, which generates revenues from cloud-dependent collaboration tools for enterprises such as Gmail, Docs, Generate, Calendar, and Meet up with.

A snapshot of just some of Alphabet’s offerings (Google)

The ultimate offering from Alphabet is the Other Bets area, which is fundamentally venture capital. It invests in emerging corporations at various phases of enhancement with a aim for them to becoming thriving, prosperous corporations in the medium to long phrase. The most nicely-recognised of these Other Bets is most likely Waymo, an autonomous driving start-up.

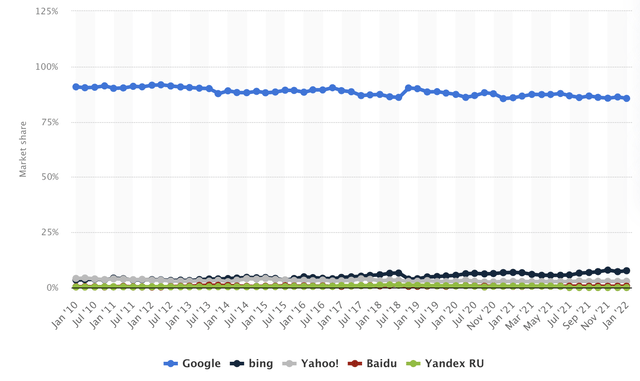

Alphabet has a solid enterprise product across numerous of these distinctive parts. In the look for motor marketplace, Google is the crystal clear chief and has been for some time, with a world-wide marketplace share higher than 85% as of January 2022 according to Statista. When it comes to Look for, Google has clear aggressive benefits from its manufacturer name as nicely as a technological benefit its device studying has outperformed all other “competition” more than the previous decade.

International Search Engine Market place Share (Statista)

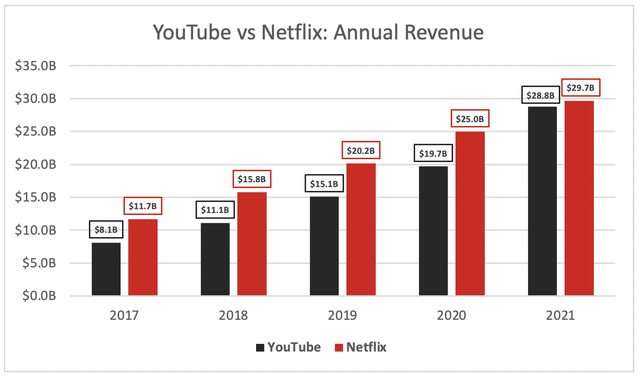

The company also acquired YouTube again in 2006 for a whopping $1.65 billion… which, provided YouTube’s current efficiency, appears to be like like an absolute steal! In simple fact, YouTube grew revenues to an impressive ~$29 billion in 2021, virtually overtaking the pure-play streaming chief & fellow FAANG member Netflix.

SEC Filings, Excel

Let’s not neglect about Google Cloud it may nonetheless be driving leaders Amazon and Microsoft, but has the prospective to be a sizeable revenue driver for Google around the upcoming a long time, as we have currently seen with AWS and Amazon (& as I highlighted in a new write-up). Google is still really significantly in the expense phase of its cloud infrastructure, and I feel its potential looks vivid here as well.

It really is plain that Alphabet has a bunch of amazing corporations, with quite a few dominating their core industries… but who cares? Specifically the same could be said for the rest of the FAANG shares. So likely on the assumption that all these organizations have superb business styles, what separates Google from the relaxation of the pack?

Fiscal Fortitude

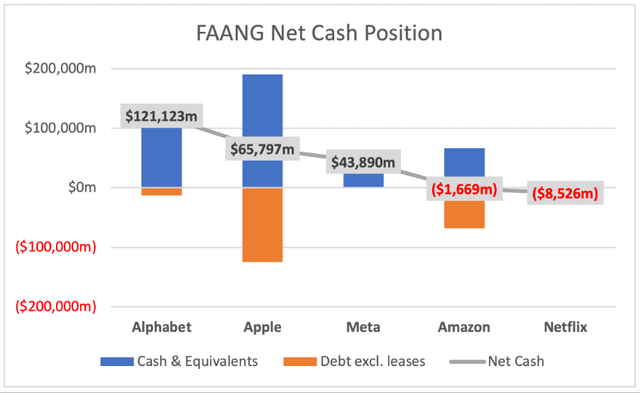

Just one of the biggest motorists for upcoming progress when it arrives to these FAANG shares is their ability to diversify, consider out new factors, and discover exciting, impressive, and most likely lifetime-changing systems to develop new revenue streams – but in buy to do that, the businesses should be both of tho

se monetarily safe & also have a war upper body of dollars to expend. So, how do they stack up? Alphabet is in a league of its own, with just about double the net hard cash place of its closest FAANG competitor Apple.

SEC Filings / Excel

This, blended with Alphabet’s continuous tries to discover and acquire the up coming ‘big thing’ to drive their enterprise ahead should really be a profitable mix for shareholders. The organization even phone calls out its approach to “Moonshots” in its annual report:

A lot of businesses get relaxed performing what they have often carried out, creating only incremental modifications. This incrementalism prospects to irrelevance in excess of time, primarily in technological know-how, where modify tends to be revolutionary, not evolutionary. Individuals believed we were ridiculous when we acquired YouTube and Android and when we launched Chrome, but individuals initiatives have matured into important platforms for electronic video and cell devices and a safer, well-known browser. We continue to glimpse toward the future and to make investments for the extended term inside of every single of our segments. As we mentioned in the first founders’ letter, we will not shy away from significant-possibility, superior-reward initiatives that we believe that in, as they are the vital to our extended-time period accomplishment.

So not only does Google have the culture to pull off these Moonshot makes an attempt, but it has the hard cash on hand as very well.

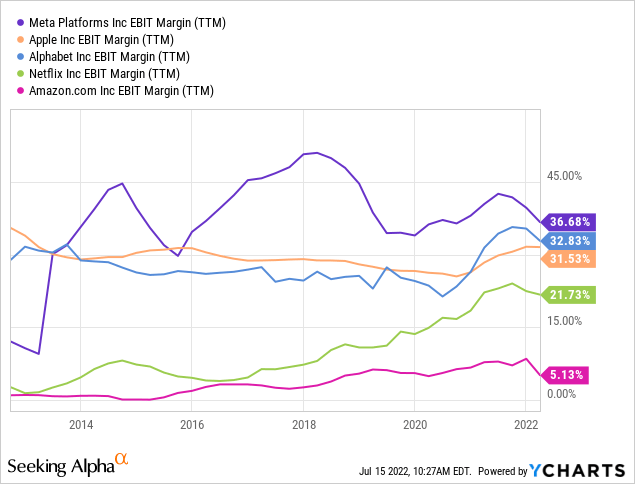

What about the business product alone? Is it designed in a way these types of that it will continue to produce benefit for shareholders? I personally appear for robust margin profiles in any enterprise that I commit in, and Google has regularly generated the second highest EBIT margins among the any FAANG inventory – next only to Meta, who I am not the biggest fan of for causes that I point out in this preceding article.

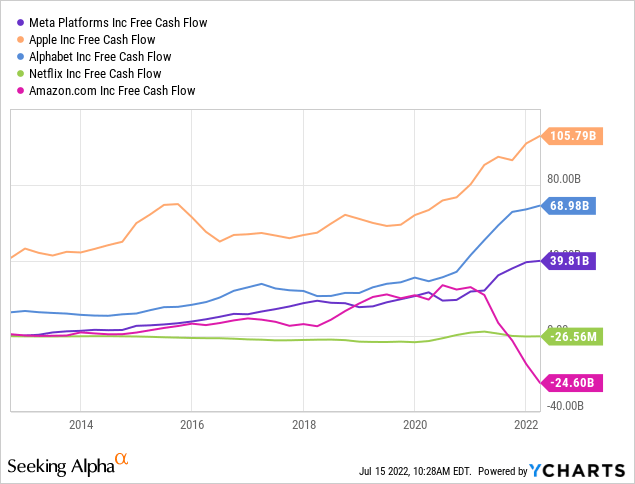

Mix these superior margins with an presently insane dollars stability, and you get a business enterprise that will not only keep on to print cash, but is also in a ridiculously solid position to take risks and reinvest in any possibilities for advancement – these types of as Google Cloud. If we also choose a look at free hard cash circulation in absolute phrases, Google is also the 2nd most effective of the FAANGs – this time next to Apple.

It’s clear that Google has one of the very best economic profiles of any FAANG shares, but what does the foreseeable future maintain for this tech behemoth?

Progress Prospects

Whilst the past and existing have designed Alphabet the organization it is today, and aided to establish out a fairly impenetrable moat, the exact exact can be claimed for many other FAANG stocks. The issue now is no matter whether or not any of these FAANG corporations can continue on their heritage of outstanding progress, because this is what will be desired to keep shareholders delighted.

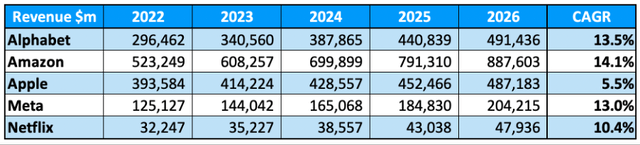

I believe that that Alphabet has a amount of tailwinds in its back for the ten years forward secular progress in electronic marketing (Google Research), secular advancement in streaming (YouTube) secular advancement in cloud computing (Google Cloud), and several additional advancement stories that Alphabet is involved in. Nonetheless a selection of traders will make the pretty exact scenario for all the other FAANG shares, so let us consider a appear at what the analysts imagine will take place above the upcoming 5 a long time, courtesy of TIKR.

TIKR.com / Excel

In phrases of income progress, Alphabet will come out in its apparent favored situation – second greatest, this time at the rear of yet one more distinct FAANG competitor, Amazon. Although the variation between Alphabet, Amazon, and Meta is compact in terms of the expected CAGR, I believe this demonstrates that progress is undoubtedly still there for these providers & they have an option forward. Apple, one of the inventory market’s darlings, is unquestionably not expected to mature at a equivalent fee to these companies – so potentially we will start off seeing a transform at the major of the FAANG?

Valuation

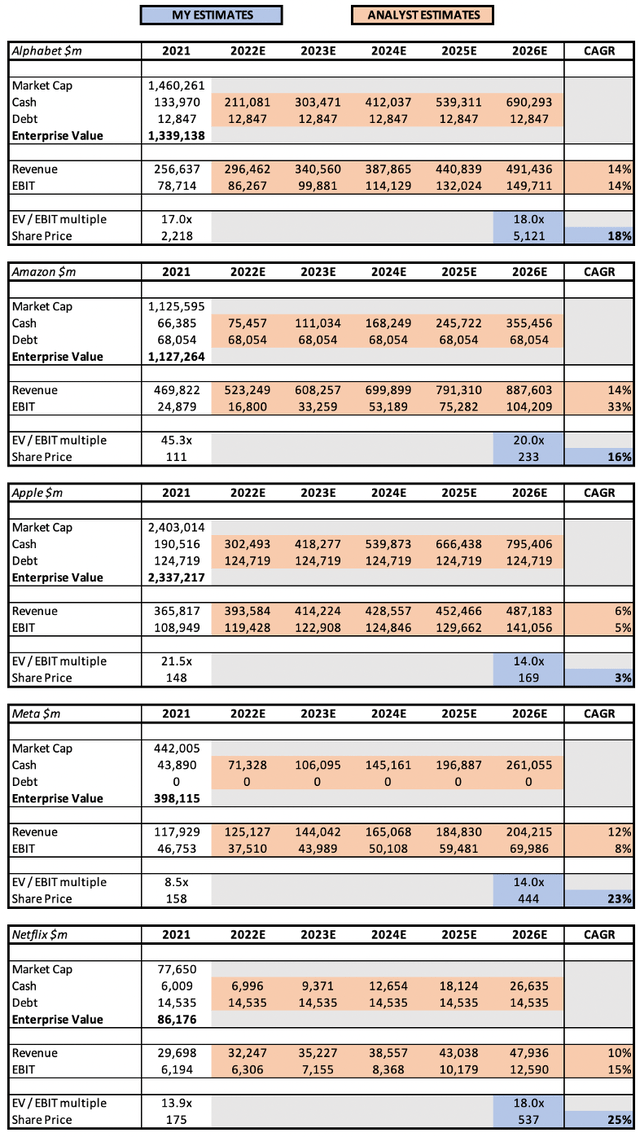

Let us get down to valuation, due to the fact at the end of the day these are all distinctive businesses with diverse paths in advance, and consequently they must all have diverse valuations. I’m heading to use a marginally simplified version of my common valuation design to get a rough thought of the unique valuations of these enterprises compared to their 2026 probable.

TIKR.com / Excel

In case it is tough to see from the model, these are the final results for the share value CAGR as a result of to 2026:

- Alphabet: 18%

- Amazon: 16%

- Apple: 3%

- Meta: 23%

- Netflix: 25%

In terms of EV / EBIT multiples, I imagine that 12x signifies an appropriate numerous for a secure business, and a 16x numerous represents an acceptable many for a steady-still-growing business enterprise. Amazon will get a bigger numerous because of to the potential for EBIT margin growth, Apple gets a reduce a number of owing to its lower advancement fees, and Meta receives a decreased multiple because of to the risk affiliated with both equally its impression as a company & the tried metaverse shift.

In accordance to my model Meta and Netflix are furnishing the ideal return, but why is this? Due to the

fact I experience like these corporations are presently most at hazard of failing to realize their development amount. Meta is going through a genuine public relations problem, and the transfer into the metaverse feels like a extended shot that HAS to do the job for the firm, usually it could experience a tough foreseeable future. Netflix is equally risky ideal now, as it has been hemorrhaging subscribers and investors are awaiting a turnaround. I never imagine that pitfalls of these concentrations exist for Alphabet, Amazon, or Apple. This explains why equally Netflix and Meta are at this time trading at valuations that seem to be way below honest price – the industry is sensible, and price ranges in this threat.

What’s The Summary?

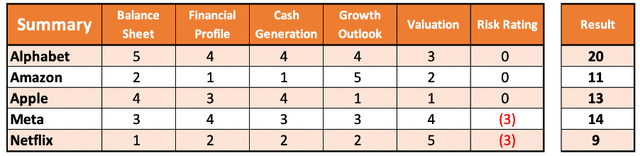

I’ve taken a glimpse at Alphabet with regard to the other FAANG shares, but how do I conclude which is the finest of the bunch? Perfectly, I’ll test and do it in a methodical method – by position every single corporation in each individual class out of 5, and then seeing who receives the top rating.

Excel

Whilst all the FAANG shares excel in a single or two specific spots, Alphabet is the only just one that has strengths across the board. I will not assert to state that this simplistic ranking process gives an correct forecast of the results of these FAANG shares – I personally want Amazon as an expenditure more than Apple or Meta. But what it does show is that Alphabet seems to be a considerably extra effectively rounded business.

All of the companies above are amazing in their possess right. Yet I imagine that Alphabet is actually in a class of its individual, and will establish to be the very best FAANG inventory around the upcoming decade.