Google Stock (GOOGL): Strong Buy Despite Q2 Earnings Miss

Chris Hondros

Alphabet Inventory (NASDAQ:GOOGL) Earnings Miss

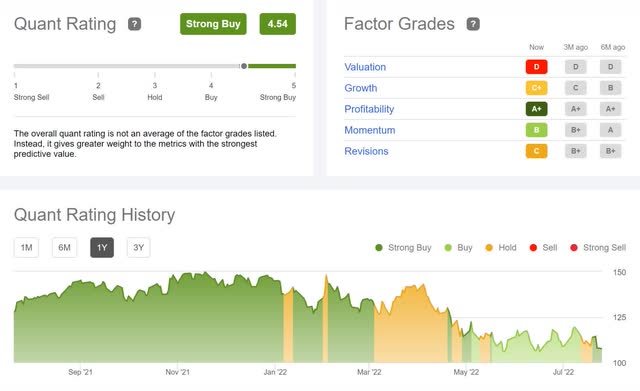

Days right after Snap Inc. (SNAP) reported dismal earnings following a pullback in promotion dollars and a tough outlook, Alphabet Inc. (NASDAQ:GOOG), best recognised for its Google items and products and services such as Android, Chrome, and Cloud expert services, missed earnings and profits for the 2nd consecutive quarter. In spite of this pass up, the inventory is up just about 5% write-up-market place and continues to be a Potent Buy in accordance to Trying to find Alpha’s quant rankings.

Alphabet Stock Quant Rankings and Issue Grades (Searching for Alpha Premium)

Alphabet Inc.

-

Current market Capitalization: $1.42T

-

Quant Ranking: Sturdy Invest in

-

Quant Sector Rating (as of 7/26): 10 out of 249

-

Quant Marketplace Position (as of 7/26): 3 out of 62

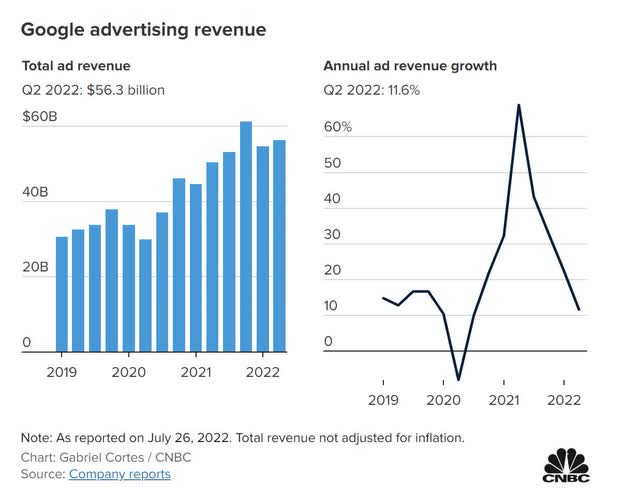

Economic uncertainty is weighing on the tech behemoth’s financials and outlook, as weak results, mainly in the type of limited advertising dollars, led to decrease quantities. Several companies in just the tech sector are having difficulties to increase their promotion pounds and earnings. Nonetheless, Alphabet managed to expand its advertising and marketing revenue 12% 12 months-over-year to $56.3B, driven by vacation and retail. Its YouTube promoting earnings of $7.3B is up 5%, and network advertising and marketing earnings was up 9%. “The quarter-on-quarter deceleration in equally YouTube and community advertising and marketing revenues mostly demonstrates pullbacks in devote by some advertisers,” stated Ruth Porat, Alphabet CFO.

Google Advertising Earnings Chart (CNBC)

In spite of the sector volatility and potential headwinds prompting the decrease in promotion, a strong U.S. greenback and weakening demand from customers is forcing Google to be a lot more strategic in an exertion to improve and stay profitable.

A potent U.S. dollar can negatively effects revenue streams from global product sales, but a lot of Google’s earnings decrease is attributable to using the services of 10,108 new personnel in Q2 for technical roles in its determination to method, engineering, and the long term.

“As advertisement gross sales sluggish for lots of companies, Google has regularly pulled in good advert revenue by shifting its emphasis toward locations where by the enterprise can be sharper…Google’s purchaser facts, together with retailer partnerships, can assist it improved brace for an e-commerce slowdown,” explained Scott Sullivan, main revenue officer at Adswerve, an on the internet promotion firm.

Google is targeted on technical facets and is committed to its long term. With three situations the income reserves of rival Apple (AAPL) and a person of the most effective stability sheets around the globe, Alphabet’s marketplace worth and outlook is very eye-catching.

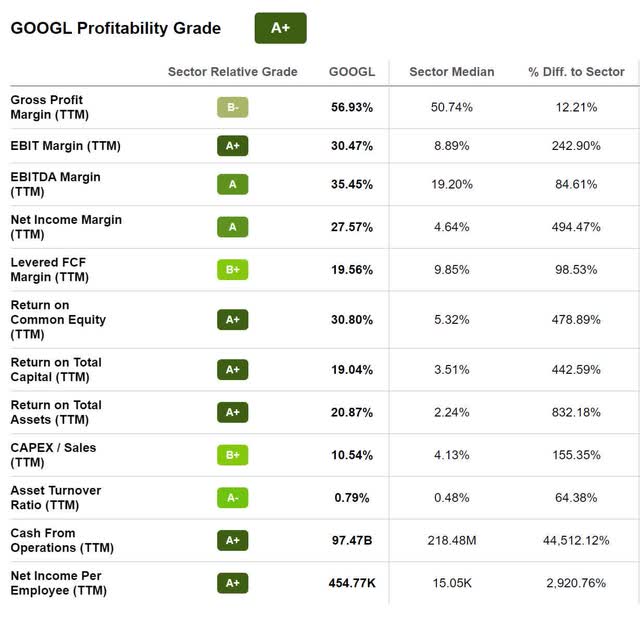

Alphabet Inventory Progress and Profitability

With Q2 EPS of $1.21 missing by $.08 and earnings of $69.69B lacking by $111.87M, the company’s weaker than anticipated earnings have been not as lousy as expected. CPI is at 9.1%, and shopper spending is suffering from a pullback as stagflation and economic downturn talks persist. And while Google’s pullback in promoting profits is sensation the results, the business stays really financially rewarding, even as currency fluctuations pose headwinds.

Alphabet Inventory Profitability Quality (Looking for Alpha High quality)

According to Ruth Porat, forex fluctuations have produced a 3.7% reduction in revenue development offered the strengthening greenback. As a consequence of the dollar’s power, the up coming quarter’s results could see an even more substantial decrease in income ensuing from “uncertainty in the world economic setting. And then, there are issues that differ across sector. You have noticed it in the news for some of provide chain, for some of its stock troubles.” -Porat.

But significant funds from operations, remarkable EBIT margins, and fundamental development and profitability metrics make it possible for Alphabet to stay a robust invest in. Its sizeable no cost income circulation of $16.5B makes it possible for shareholders to finance buybacks. Alphabet has managed to aggressively repurchase its shares. Provided its potential to strategically posture alone to capitalize on unique opportunities that involve numerous item and company choices that established it aside from opponents, the organization may be equipped to carry on a ramp-up in buybacks going ahead. As Searching for Alpha Marketplace writer Jonathan Weber writes:

“I do consider that Alphabet is a extremely stable company with a beneficial very long-time period outlook, and the present-day valuation is eye-catching. I also believe that there is a great prospect that traders will be content when purchasing at latest economical costs, particularly when administration follows by means of with its headcount adjustments that must make margins boost once more.”

Alphabet Inventory Valuation & Momentum

Though the IT sector is concentrated and quite a few preferred names possess stretched valuations, Alphabet is investing at 52-week lows. When its D valuation grade is not perfect, its ahead P/E ratio of 19.56x is only a 6.5% distinction to the sector. Its forward PEG

of 1.04x, an significant metric that blends benefit and progress, is a -27.56% big difference to the sector. Though Alphabet is rather expensive compared to the sector, its YTD share price decline of 27% and a person-calendar year price drop of 21% is attractive to some investors on the lookout to acquire it in the vicinity of its reduced. Coupled with a steadily soaring quarterly selling price performance and bullish momentum, this stock seems really appealing, which is why our quant scores advise it as a strong get.

Google It! Alphabet Is Rated a Sturdy Acquire

Even in this risky market, some tech shares can be terrific buys if you think about the macro surroundings, and detect these with good fundamentals and capitalize on their advancement and momentum. Investors really like tech stocks, and the good thing is, Alphabet is the only well-known mega-tech title rated a strong invest in according to Trying to get Alpha’s quant ratings. Alphabet’s products and solutions keep on being in large demand, and the stock possesses forward EBIT growth of +65%, which is an extraordinary growth amount.

In the present-day natural environment wherever the tech sector is -21% and Alphabet is trading in close proximity to its 52-7 days lower of $102.21 for every share, it delivers a one of a kind possibility to acquire a remarkable firm at a lower exactly where your portfolio has the option to capitalize on potential upside. In addition to Alphabet, we have dozens extra Leading Technological know-how Shares for you to pick out from. Our quant grades and expense exploration applications help to be certain you are furnished with the most effective means to make informed investment decision decisions.